Get Your

Without Dealing with complicated legal forms

Join over 3000+ clients who are using their ITIN to get paid.

Got Any Questions?

Let Us Help!

✓ Friendly, Helpful Support

✓ Quick Response Times

✓ Real People Who Listen

✓ Solutions Tailored to You

✓ 100% Free Assistance

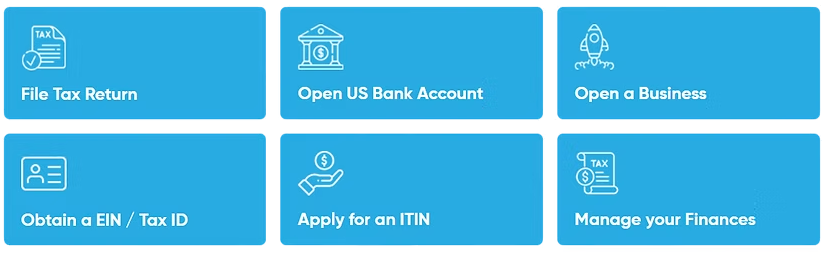

ITIN Filing Services

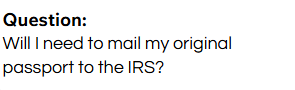

Your dedicated Certified Acceptance Agent will guide you through every step and carefully review your application to reduce the risk of rejection. You won’t need to mail your passport — Certified Acceptance Agents are authorized and trained by the IRS to verify and accept your documents directly.

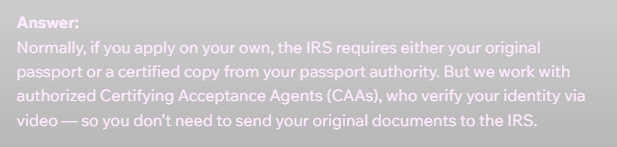

Obtain an EIN Without an SSN

There are three ways to apply for a U.S. EIN without a Social Security Number:

By Fax – Fast processing, usually within 4 business days.

By Mail – Slowest method; can take 3+ months to receive your EIN.

By Phone (International Applicants Only) – Quickest, same-day processing in many cases.

We handle the phone and fax applications for you, so you get your EIN as fast as possible. Unlike other providers who rely on mail, we streamline the process to save you weeks.

Full-Service Application: We complete all paperwork for you.

Fast & Reliable: Receive your EIN in days, not months.

Support Included: Guidance every step of the way.

Start your EIN application today and get your U.S. business up and running quickly—without needing an SSN.

Business Organization Options

Choosing the right business structure is crucial for your U.S. company. We help you select and set up the organization that best fits your needs, whether you’re a solo entrepreneur or running a larger operation.

Common U.S. Business Structures:

LLC (Limited Liability Company) – Protects personal assets and is flexible for small to medium businesses.

Corporation (C-Corp or S-Corp) – Ideal for investors, scaling, and complex ownership structures.

Partnership – Shared ownership and responsibilities, simpler setup for multiple founders.

How We Help:

Recommend the best structure for your goals

Handle all registration paperwork with the state

Ensure compliance with U.S. laws from day one

With our guidance, your business will be properly organized and legally compliant, saving you time and avoiding costly mistakes.

Accounting & Bookkeeping

Proper accounting is essential for your U.S. business to stay compliant and avoid penalties. We help international business owners set up and manage accounting with simplicity and accuracy.

Our Accounting Services Include:

Bookkeeping Setup – Organize your financial records from day one.

Tax Compliance – Ensure your business meets IRS and state reporting requirements.

Financial Reporting – Monthly or quarterly statements to track your business performance.

Why Choose Us:

Expert Guidance: We handle the accounting setup so you can focus on running your business.

Streamlined Process: Save time and avoid common mistakes.

For International Clients: Designed for non-U.S. residents to manage their U.S. company remotely.

With our support, your business stays financially organized, compliant, and ready to grow.

DON’T WAIT!

Start Your

Next Filing

Today!

No SSN Required (For Non-U.S. Citizens) Stay compliant with tax reporting requirements, handle state filings with ease, and never miss an important deadline. Reduce the risk of rejection by using our fast, hassle-free online applications.

Speed is what we do🏃♂️💨